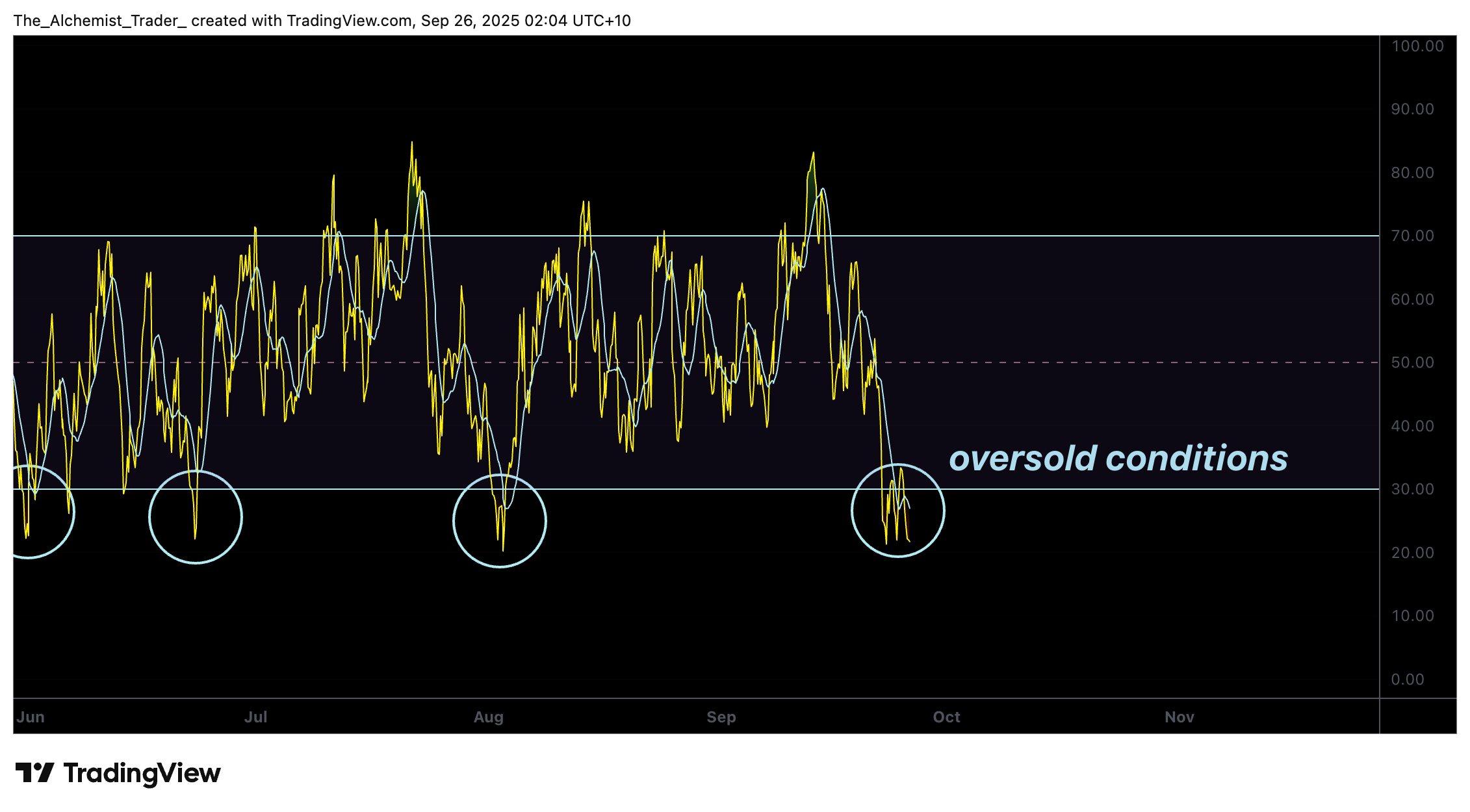

Solana Price Drops to $200 Support as RSI Signals Oversold Conditions

Solana’s price has notably retreated from the $260 resistance level, now resting in the $200 support zone. With the RSI indicating oversold conditions at the moment, traders are anticipating a potential bounce back.

Overview

- Solana’s price has declined from the $260 resistance to the $200 support zone.

- The 0.618 Fibonacci retracement coincides with the oversold RSI, forming a strong technical confluence.

- If the $200 support level holds, Solana may bounce back toward the $230–$260 range.

Solana’s price action shifted dramatically after nearly hitting $260. A series of higher highs and higher lows formed a bullish pattern until resistance halted the upward movement. This triggered a steep sell-off, breaking below the point of control (POC) and the value area high (VAH) before consolidating around the $200 level.

This area aligns with the high-time-frame 0.618 Fibonacci retracement, a spot where Solana has historically displayed significant reactionary moves. Adding to this, Kazakhstan is set to introduce a stablecoin backed by Solana, Mastercard, and a prominent local bank, potentially boosting Solana’s long-term outlook.

Key Technical Points for Solana’s Price

- Support Assessment: The price has retraced to the $200 area, consistent with the 0.618 Fibonacci confluence.

- Oversold RSI: The current RSI reading is below 30, indicating a likely exhaustion of selling pressure.

- Potential Bounce: Historically, Solana tends to rebound from 0.618 levels toward previous high points.

The recent bearish trend was rapid and severe, similar to previous occurrences where Solana reacted to the 0.618 Fibonacci retracement as a critical level. This noteworthy high-time-frame support could draw buyers looking for value following the decline.

From a structural perspective, the $200 support level stands as more than just a Fibonacci alignment; it also acts as an important psychological round-number milestone where liquidity pools are likely to accumulate. A recovery from this level could re-establish Solana’s bullish trend by directing price action back towards neutral volume levels such as the VAH and ultimately retesting the $260 resistance level.

Momentum indicators further support this viewpoint. With the RSI currently below the 30 mark, oversold conditions are evident and typically not sustainable for long periods. In the past, drops below this threshold have reliably resulted in relief rallies, driven by short covering and opportunistic buying from bulls.

Monitoring volume will be critical for validating this outlook. If demand resurfaces at these lows, it could indicate the end of the current bearish phase and lay the groundwork for another bullish trend. Conversely, failing to sustain the $200 support could reveal deeper liquidity levels, with further supports positioned below.

In addition to this, PancakeSwap is now enabling Solana in cross-chain swaps, permitting users to effortlessly trade tokens across various blockchains.

Anticipations for Upcoming Price Action

In the short term, Solana’s oversold RSI and strong support at $200 suggest a potential rebound. Successfully defending this level could trigger a movement towards the $230–$260 range.